Valid Active Single or Joint 'B' Savings account standing at CBS Sub Post Office or Head Post Office. Accounts standing at Branch Post Office are not eligible for availing Internet banking facility. Provide necessary KYC documents, if not already submitted. Government of India. Post Office Saving Account customer to submit duly filled request form in respective Post Office, After enabling desired service in customers Savings Accounts by Post Office, customer will get activation code on his/her mobile within 48 hours to proceed further.

Now PPF account holders can deposit money online through India Post Payment Bank (IPPB) application.

In this coronavirus time or otherwise one can deposit money online in the PPF account.

Public Provident Fund is one of the most popular tax-saving instruments in India. PPF is a 15-year scheme backed by the Central Government of India.

It is a completely safe and secured scheme which is backed by the Government of India. Black dream catcher.

- Firstly you have to deposit money from your bank account to your IPPB account.

- Go to the DOP service.

- Choose the product in which you want to deposit the money like a recurring deposit, PPF account, loan against recurring deposit or other.

- Enter your PPF account number and DOP customer ID.

- Mention the amount that needs to be deposited and click on pay option tab.

- the IPPB will notify you for successful payment transfer made through the mobile application.

- You can opt for various post office investment options provided by India post and make payment through IPPB basic saving account.

How to register for IPPB mobile App

For New Clients

Open your digital savings account by following on-screen instructions.

After downloading the app, you have to give your mobile number and PAN card number.

Once you click submit it will generate an OTP.

Submit the OTP.

It will aks for AAdhar card number or otherwise you can scan QR code on Aadhard card.

Again you will get OTP. Submit the OTP and follow the on screen instructions and you will be able to open your account.

For existing customers

STEP 1 Enter the details:

- Account number,

- Customer ID (CIF) and DOB

- registered mobile number

2)You will receive a one-time-password (OTP) on your registered mobile number

3) Set MPIN Alabama leprechaun song.

4) Enter the OTP

You are ready to make any number of transactions you like.

Open An Online Savings Account

India Post Savings Account

Additional resources :https://www.youtube.com/watch?v=HK_vgGQQTzw

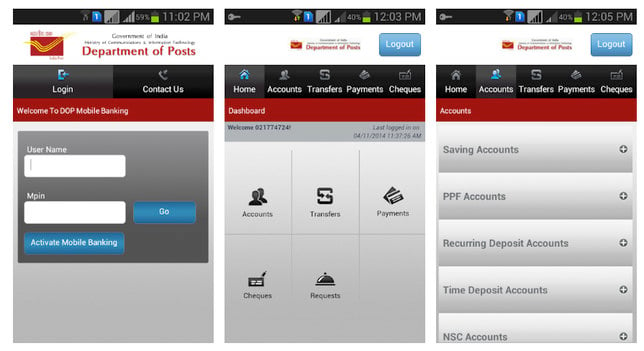

Currently available services on Mobile Banking:

India Post Savings Account Ifsc

- Account balance enquiry

- Request for a statement of your account

- Request for a cheque book (Current Account)

- Stop payment on a cheque

- Transfer funds within the bank

- Transfer funds to other bank accounts

- Pay water, electricity and utility bills

- Recharge prepaid and DTH (direct-to-home) services

- Manage your funds with the linked POSA (Post Office Savings Account) by using Sweep-in and Sweep-out facility