Standard Chartered Fixed Deposit Minimum Deposit. Interest Rate (p.a) 1.60%. Investment Returns RM 160.00. Hong Leong Fixed Deposit Minimum Deposit. Interest Rate (p.a) 1.60%. Investment Returns RM 160.00. AmBank Islamic Term Deposit-i Minimum Deposit. If you invest in a Standard Chartered Bank fixed deposit, you can get interest rate of up to 7.50% p.a. The tenure range for the FD is between 7 days and 5 years. Standard Chartered Bank FD Interest Rates Range of maturity period: 7 days to 5 years.

Standard Chartered Singapore

Standard Chartered Usd Fixed Deposit, Standard Chartered fixed deposit schemes allow you to earn greater interest on your savings than you would otherwise get with traditional savings accounts under the condition that you do not touch your deposited funds for a pre-set period of time.

The bank offers 2 different types of term deposit accounts: Singapore Dollar Time Deposits and Foreign Currency Time Deposits. With the Foreign Currency Time Deposits, you may choose to deposit your funds in any of the 8 major currencies offered by the bank.

The minimum deposit placement amount required for both types of accounts is 5,000 units of the respective currency. You can earn as much as 2.7% p.a. interest on tenures of up to 60 months when you secure your excess funds in term deposits with Standard Chartered.

Standard Chartered Fixed Deposit Interest Rate

All Standard Chartered Singapore Dollar Time Deposits offer tenures ranging from 1 month to 60 months.

This table illustrates the fixed deposit interest rates offered with this account:

| Deposit Amount (SGD) | Tenure (% p.a.) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Month | 3 Months | 6 Months | 9 Months | 12 Months | 15 Months | 18 Months | 24 Months | 36 Months | 48 Months | 60 Months | |

| Below 20,000 | 0.150 | 0.200 | 0.250 | 0.650 | 0.700 | 0.850 | 0.850 | 0.850 | 0.970 | 1.100 | 1.350 |

| 20,000 – 49,999 | 0.150 | 0.200 | 0.250 | 0.650 | 0.700 | 0.850 | 0.850 | 0.850 | 0.970 | 1.100 | 1.350 |

| 50,000 – 99,999 | 0.150 | 0.200 | 0.250 | 0.650 | 0.700 | 0.850 | 0.850 | 0.850 | 0.970 | 1.100 | 1.350 |

| 100,000 – 499,999 | 0.150 | 0.200 | 0.250 | 0.650 | 0.700 | 0.850 | 0.850 | 0.850 | 0.970 | 1.100 | 1.350 |

| 500,000 – above | 0.150 | 0.200 | 0.250 | 0.650 | 0.700 | 0.850 | 0.850 | 0.850 | 0.970 | 1.100 | 1.350 |

Note: The above rates are only indicative and are correct as of 23 January 2019.

Standard Chartered Foreign Currency FD Interest Rates

All Standard Chartered Foreign Currency Time Deposits offer tenures ranging from 1 week to 12 months. The interest rates provided for this time deposit account are only valid for new foreign currency fixed deposit accounts opened 2 working days after the specified date.

This table provides the interest rates offered for each of the 8 major foreign currencies available:

| Currency | Tenure | Interest rate (p.a.) |

| USD | 5,000 units to 500,000 units and above | 1.249% to 2.554% |

| HKD | 25,000 units to 500,000 units and above | 1.18% to 2.025% |

| AUD | 5,000 units to 500,000 units and above | 0% to 2.025% |

| CAD | 25,000 units to 500,000 units and above | 0.843% to 1.916% |

| NZD | 5,000 units to 500,000 units and above | 0% to 1.98% |

| EUR | 5,000 units to 500,000 units and above | 0% |

| GBP | 5,000 units to 500,000 units and above | 0.05% to 0.877% |

| CNH | 25,000 units to 500,000 units and above | 0% to 2.7% |

Note: Rates are only indicative and are accurate as of 18 December 2018.

Features and Benefits of Standard Chartered FD

- Affordable minimum deposit amount starting at S$5,000 or its equivalent in chosen foreign currency.

- Flexible tenors ranging from 1 week to 60 months.

- Guaranteed automatic renewal of time deposits at maturity.

- Consolidated statements of all your Standard Chartered accounts for added convenience.

- Easily accessible banking through online banking or telephone banking facilities.

- Affordable minimum deposit placement amount of S$5,000 or its foreign currency equivalent.

Standard Chartered FD Schemes

Singapore Dollar Time Deposit

You can enjoy up to 1.35% p.a. interest on Standard Chartered SGD term deposits with tenures that range from 1 month to 60 months. This account requires a minimum deposit placement amount of S$5,000 for SGD deposits of up to S$500,000 and above.

Foreign Currency Time Deposit

If you foresee needing to use any foreign currencies in the future, this fixed deposit account may come in useful for such an occasion. You can earn up to 2.7% p.a. interest on foreign currency deposits with flexible tenures ranging from 1 week to 12 months. The 8 major foreign currencies you may place your deposits in are: US Dollar (USD), Sterling Pound (GBP), Australian Dollar (AUD), New Zealand Dollar (NZD), Euro (EUR), Canadian Dollar (CAD), Hong Kong Dollar (HKD), and Chinese Renminbi (CNH).

Eligibility Criteria to Open an Standard Chartered FD Account

- Minimum age: 18 for Singapore Dollar Time Deposits.

- Minimum tenor: Starts from 1 week.

- Maximum tenor: Up to 60 months.

- Requirements: Valid Singapore mobile number.

- Minimum placement amount: Starts at S$5,000 or 5,000 units of the chosen currency.

Required Documents:

- Singaporeans & PR holders: NRIC (back and front)

Foreigners:

- Valid passport

- Employment Pass

- Any utility bills/bank statements/rental agreements (from last 3 months) for proof of address

Other Deposit Accounts Offered by the Bank

Standard Chartered offers several savings and chequing accounts that you may want to learn more about in order to help you meet your everyday banking needs.

Current accounts available with Standard Chartered include:

- Bonus$aver

- SuperSalary

- XtraSaver

- Cheque and Save Account

- USD High Account

Savings accounts offered by Standard Chartered include:

- e$aver Savings Account

- FCY$aver

- e$aver Kids

- MyWay Savings Account

- USD$aver

- Basic Bank Account

How to Close Standard Chartered Bank Fixed Deposit Account?: Bank Fixed Deposit or Term Deposit is a deposit scheme where you can invest money in lump sum for a fixed pre-decided tenure at a given rate of interest. Standard Chartered Bank offers Fixed Deposit (FD) products of multiple tenures at competitive interest rates and with many other benefits like loan or overdraft facility against Fixed Deposit. Free virtual bingo card. It is usually seen that if someone opens a bank FD account, he/ she rarely closes it before maturity in order to achieve the financial objectives for which it was opened. Premature closure is not considered a good option as you bear financial loss if you close your FD before maturity.

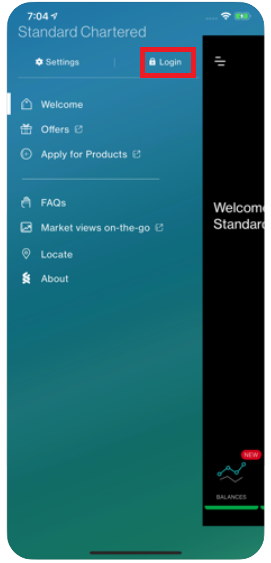

Standard Chartered Online Banking

However, still there could be multiple reasons to close a bank Fixed Deposit Account such as:

- Emergencies in the family

- Lower rate of interest

- Customer Service is not upto the mark

- Requirement of funds for purchase of some asset

- Bad Relationship with Bank Staff

- Better interest rate is being offered by other bank

- Better opportunity for investment

In order to close your Fixed Deposit Account, you may be interested to know how to close bank Fixed Deposit Account? It seems tedious but it's very easy to get your account closed, you just need to follow a few steps for the same.

Alternate Ways instead of Closing Bank Fixed Deposit Account of Standard Chartered Bank

- A loan against fixed deposits can help you manage finances without breaking your investment.

- Arrange the funds for emergency from your family, friends or relatives, if your FD maturity date is very close.

- Avail Personal Loan, in case it is financially viable option.

Standard Chartered Fixed Deposit Rates

How to close Standard Chartered Bank Fixed Deposit Account?

If you have a Fixed Deposit Account with Standard Chartered Bank and interested to know how to close it then following are the steps will have to follow:

(1) Fill up the FD Account Closure Form or Fixed Deposit Liquidation form of Standard Chartered BankIn order to close Standard Chartered Bank FD account, the first step is to fill up an FD Account Closure Form. For this, you can visit your branch, get the FD account closure form and fill it up properly. After that you need to sign it and submit it to the branch manager/ officer-in-charge. Please note that if there is/ are any joint holder/s in your account, all need to sign the FD account closure form.

(2) Attach your KYC (Know Your Customer) Documents

All the holders of the account need to attach a copy of KYC documents i.e. a copy of PAN, which also serves as your proof of identity and a proof of address to the FD closure form. The account holders may also be asked to self attest these documents.

(3) Submit FD Certificate or FD ReceiptWhenever you apply for bank FD, the bank issues a deposit certificate or receipt as a proof of fixed deposit. Jackpot cash no deposit coupons near me. It shows the details like FD amount, Tenure and Rate of Interest. You need to carry this certificate or receipt to close a fixed deposit. You need to submit FD certificate or receipt duly signed by all the account holders. The banker will verify the documents submitted by you and if he/ she finds all the things are correct then you are asked to withdraw the balance amount in your account. You may either take cash withdrawal or the bank issues a cheque/ DD in your favour or the amount can be transferred to another account.

If you follow above steps, you would be able to close your FD account in a hassle free manner. Banks generally send an email or SMS on your registered email id and mobile after your FD account is closed.

Standard Chartered Term Deposit Rates

Important Points regarding Closing of Standard Chartered Bank Fixed Deposit Account

- For closing your FD account, you need to visit that branch of the bank where you had opened the account.

- Some of the banks offer FDs with minimum lock-in period which means that if you withdraw your FD before the lock-in period, no interest will be paid.

- On premature closure of Fixed Deposit, usually a penalty of 0.50% to 1% lower interest is levied. One will not get the original interest on FD amount for the entire tenure of the FD, but will be paid the lower interest rate less penalty for the period in which the FD was withdrawn.

- Any type of tax-saver FD cannot be withdrawn prematurely i.e. you cannot withdraw the amount before a lock in period of 5 years.

- Loan and Overdraft facility is not available against tax-saver FDs.